In today’s interconnected world, businesses aren’t limited by borders — and neither should your finances be. Global business accounts offer powerful solutions for companies expanding internationally, but are they right for your business? Here’s a clear breakdown of the benefits of CICO global accounts to consider.

Hold, send, and receive payments in multiple currencies, reducing costly conversions and giving you full control over international transactions.

Streamline payments to suppliers, partners, and teams across the globe with faster processing times and fewer intermediaries.

With global accounts, your business can establish virtual IBANs in multiple jurisdictions — helping you appear local to your customers and partners, while managing everything from a single platform.

Consolidate your international balances into one global view, improving cash flow visibility and optimising how you manage working capital.

CICO Global accounts often offer better exchange rates and lower fees compared to traditional banks, especially for businesses making frequent international transfers.

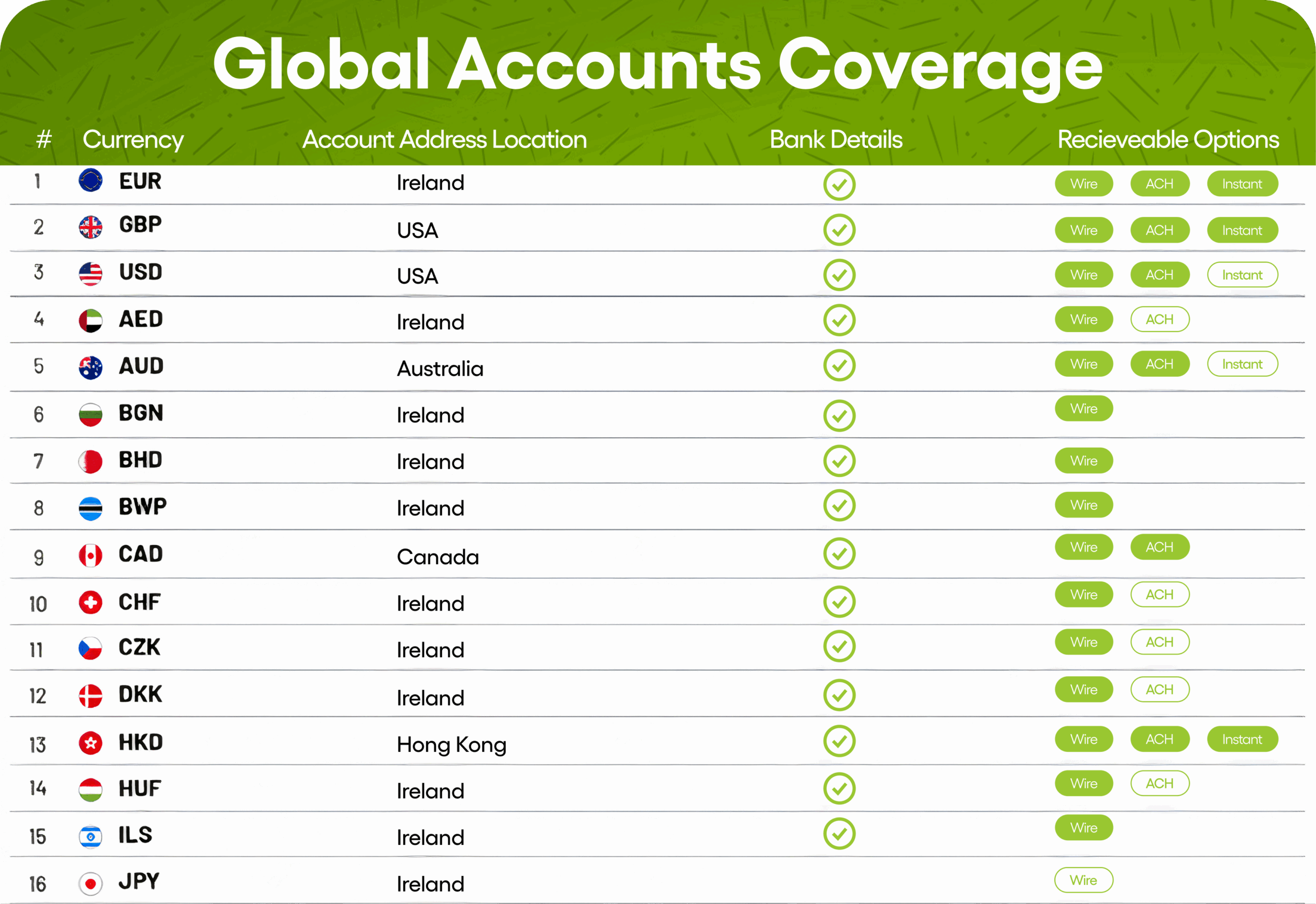

| Currency | Account Address Location | Bank Details | Recieveable Options |

|---|---|---|---|

| EUR | Table Data | ||

| GBP | Table Data | Table Data | Table Data |

| USD | Table Data | Table Data | Table Data |

| AED | Table Data | Table Data | Table Data |

| AUD | Table Data | Table Data | Table Data |

| AUD | Table Data | Table Data | Table Data |

| AUD | Table Data | Table Data | Table Data |

| AUD | Table Data | Table Data | Table Data |